A Strategic plan to increase air sales and margins with no additional investment and zero cost increase!

Author : Sanjay Shenoy [Founder & CEO – Airline Metrics]

Introduction

We have all heard the saying Cash is King.

I disagree. I say Profit is King. Cash could be borrowed but profit is pure margin.

Now that the travel industry has changed forever with COVID it is time to focus back on the business basics – profit. As a consolidator, TMC, OTA, retail agency chain, buying group or tour operator no doubt each and every effort you are putting in is towards returning a higher margin. Having been through the worst, our industry is now collectively looking at major changes to how we operate. So what we have to aim for is transformational change. A complete inside out process to ensure we turbo charge our profits from sales.

After consulting to and dealing with hundreds of businesses in travel I kept finding that money was always being left on the table by travel agencies. Even the best run agents had opportunities to rake in higher margins but were not focused enough to do so. Not that they were not smart or intelligent business people. In fact, quite the opposite – some of the smartest and cleverest people I have met have been in travel. Yet, there was always some other priority related to the business that took precedence – sales, service, suppliers, technology, marketing, staff and so on. Undeniably these are critical components of a business but let’s be honest – so is profit isn’t it? So why was there not an unrelenting focus on this by each and every agent? The airlines definitely won that battle if you compare them against travel agents. They were ruthless and relentless in their cost cutting and profit improvement focus. From cutting commissions to rolling out ancillary products they responded splendidly to rising competition and costs. I am not sure I have too many examples that I can quote where travel agents collectively did the same. Why this has been the case is hard for me to understand being an analyst who specialises in profit improvement analytics.

So maybe now is just the right time to bring in all the tools of the trade to focus on boosting profits.

What to expect from this guide

Having stated my case above I do want to now set some clear expectations.

In this guide you will learn how to squeeze out every last dollar of margin from selling an airline ticket and adding to your bottom line. The processes described are not rocket science but a scientific and business focused approach that should be incorporated into each travel agency business in an ongoing manner anyway. You may already be doing some or more of these steps, but this paper will put them all into a repeatable and manageable process which will make you more money with every ticket you sell.

Some of these steps are easy and some need work. How much margin you pull out from your air business is finally up to you but with this guide we want to aim towards increasing your air margins to 3% or more on existing sales. All this with zero investment and zero cost increases. I have seen results that have been twice or thrice as much or exponentially more, but those cases are of Airline Metrics’ clients with whom I have confidentiality agreements. So I cannot reveal their names here publicly. However, the process and pathway to those riches are exactly the same as covered in this guide. If you are able to use this guide to generate the results desired, please do let me know. That would be the best reward for me to hear that we have had a positive impact on your business and your life.

All the tools used in this guide from spreadsheets to diagrams can be downloaded from our website for free on www.airlinemetrics.com/agencytools so please do visit our site for that.

Regardless of your role within the business you operate in, you can showcase a direct impact onto what is generally regarded as a low margin business – air revenue.

If you are the owner or shareholder or a C-level executive – there is obviously a direct impact for you. Your legend will also grow and you will be known as a magician or wizard.

If you are an executive within the business who brings forward these structured methods to increase profits – you know where your next promotion is coming from and also all the bling it’s going to bring with it. Or if you are just doing it from the good of your heart you will be lighting a real evangelical fire within the business to do better.

You bring in the money – you shape what you get from it – it is that simple. Flexible work days? Higher bonus? New car? Expensive Dinners? – Negotiate what you want because as the famous line from Jerry McGuire goes “Show me the money!”

It is also true that success begets success. It sets up the pathway to a more successful future by enabling you to focus on issues that are of real interest to you and will make a definite impact on the business’ future.

Problem

There are generally only two ways to grow profit as you know. Grow sales (profitably) or cut costs. Let’s then list down some challenges in growing profit and see if one or any of the statements apply to you:

- The market-share your business currently holds is the best you can have given your position in the market. It is unlikely you can increase your sales dramatically based on current market conditions.

- The airline deals negotiated with all the major carriers in the markets are at the best possible incentives you can get. There is no more to get.

- With competition in the market you can only charge a limited amount of service fees.Increasing fees is not really an option.

- Costs have been cut to the fullest extent possible and there is no more scope for any further cuts.

So how will any of the above allow us to increase our margins?

Well, the travel industry is unique; where suppliers also pay you money on your sales. So that’s where we are going to focus for now in this guide. And hold that thought where you say refer to point two above. We will address it in due course.

The scope of this guide is limited to airline suppliers only but if you can use some of the tactics towards your other suppliers – go for it. More the merrier when it comes to margins.

Now in addition to the above, let’s identify some more challenges we may be facing.

Let’s look at the one true margin earner for many travel agencies, including consolidators. Their true bread and butter – Backend Incentive Contracts also known as PLBs (Productivity Linked Bonuses) in some markets. These incentive contracts are lucrative when you hit the targets and get paid and very painful when you miss them. Do you remember the feeling when you missed any one of them?

So how can we get on top of this challenge and never miss these targets? To do so first we have to clearly identify and state the problem. After that we can look at solutions.

So what challenges do back end incentive or PLB contracts pose? We can state them in seven broad categories:

There are two fundamental issues in play here – the first being sales recorded in your mid or back-office accounting system are based on ticketed values and most incentive targets are based on flown revenue. What systems and processes have you put in place to measure your performance of these targets on an ongoing basis and to convert your ticketed revenue dataset to some form of flown revenue?

Airlines astound me sometimes with some of the amazingly complex “incentive” contracts they present to agents. I always question – are these incentive or dis-incentive contracts? I have seen 3 page to 30 page contracts that do not make any sense. They have either been written by the airline’s legal team who have no ground reality about commercials and competition and the airline market or have been written by people who have no business working at one. I can almost see you nod. You know the ones I mean. So how do you measure and meet complex target challenges repeatedly?

This is where the game is stacked against the travel agency community. All flown revenue data is held by the airline, and they are notorious for not sharing. I cannot find one single industry apart from aviation where the suppliers tell their sales representatives (travel agents) what their revenue is. How odd would it be if a Toyota dealership had to ask Toyota Head Office in Japan for their revenue numbers each month. Or an insurance agent asking the insurance company “Hey could you please tell us our monthly revenue numbers”. And yet this is the norm in our industry with no defined and consistent standards! Makes you wonder, doesn’t it?

Carriers are notorious for not reporting agency performance results on time. Not all of them but most still fall into this category. I thought one airline took the cake by reporting on their numbers one year late. That was till I met some of my customers from the USA who told me a vast majority of airlines in that market do not report their numbers at all! Say what? Which world are we living in? Hope you don’t have any of those. If you do – not to worry we will work through how you can overcome this problem.

So how do you plan to meet flown revenue targets if even the best of the airlines report these numbers to you after four to six weeks at a minimum after month end? And we know that only a handful (if that) fall into this category.

How does a carrier get away with huge discrepancies between their ticketed and flown revenue numbers? Easy! Blame it on leakage. Hey there are a lot of sectors that you ticketed on my airline and was flown on others. What do you say to that, right? And that was an easy win for them.

Hint: Ask for a coupon-by-coupon report list and reconcile them to your sector sales. Prepare to be surprised (usually by the lack of response and excuses).

If you are well prepared with all of the above, you are among the top 0.01% of the best run travel agents in the world. Congratulations and well done! But most have too much data on hand and too little resources so then it does become a challenge to manage the data for all such needs. How much resources can you allocate to deal with collating and compiling the data into meaningful information?

There are many other issues with PLBs and incentive contracts but the seven above probably capture the majority of issues faced. Those were just problems related to back-end incentive/PLB targets. We do have other challenges that we face. Let’s state those too:

- No commission from airlines with whom we do not have target-based contracts.

- Sales made which are excluded from commissions or incentives.

- Challenges relating to accessing timely data consistently.

- Having access to highly trained and knowledgeable analysts who can advise the business with regards to opportunities, risks and threats.

- Timely information related to change in market conditions e.g. change in capacity by airlines or changes in destination volumes.

We can significantly add many more items to this list but I think this provides a good enough problem statement to focus on. At this stage all we are trying to do is define the problem. Almost all businesses are aware of these at some level or other but have not really sat down and defined them in great detail.

The issue with not recognising and formally stating these problems are, they do not get the level of visibility they should. We are all guilty of chasing sales and new accounts and new contracts while not really focusing on optimising what we have. Do not worry as you are not the only one. The entire ecosystem of 99% of businesses are in this boat. But there are some dire consequences of not having concrete solutions towards dealing with them though.

Risk

Have you ever sold tickets for a loss hoping it will come good on the back end or in the future? How many times did you measure that and win? Or lose?

This issue is quite prevalent in our industry and the bigger the agency the higher seems to be the risk taking. If you lose and lose big that may well create a bigger hole to climb out of in the future especially with events like COVID lurking around every corner of the airline industry.

Long gone are the days where if you just missed the targets by a small margin the airlines would look the other way and compensate you at the higher tier level. There is NO CHANCE of that happening now. None. If you miss the target, then your compensation is gone. What is the $ value income risk on each missed contract? Have you worked that out for each airline contract? We have a risk analysis spreadsheet available on our website for free. You can download it www.airlinemetrics.com/agencytools and use it to build a risk management framework.

It is not just the incentive targets but also the tacticals where you could lose money if you do not sell a minimum number of tickets. Have you got a risk management framework for missed targets or is it something you look at in Quarter 4 when the deadline looms? Do not worry, plenty of people in that category but that is what we are going to change now with this guide.

If you miss targets, there is a risk the airline will not offer you one in the following year. As simple as that. Till you prove that you can add value it may be gone. Or they may put much higher hurdle rates for lower compensation. All this even if you miss your target by just 1%. Is it worth it?

Airlines, sub-agents, customers and many others are at times fair weather friends. As long as there is confidence in your ability to deliver the sales and numbers – all is well. But the other side of this is not very pretty. It is a small industry and it is global. Word spreads and spreads quite fast. So to avoid IATA audits and increased cash deposits or bank guarantees you need to continuously demonstrate your success and profitability.

So do you now agree? Profit is King!

Myth

Have you ever heard people within our industry saying – “there is no money in air”?

Or are you one of those people who believe no margins exist in the airline business?

This myth is so entrenched that some agents have even stopped looking or trying to earn any margin on air sales.

I can assure you that nothing can be further from the truth. Especially if you have the scale and turnover to attract direct incentive contracts from airlines.

So how did this myth perpetuate?

We all know airlines cut commissions significantly from the standard IATA norms of 5% on domestic to 10% on international after deregulation of the industry.

That led them down to zero commission levels in most markets. And by that a wide array of the travel agent population stopped getting up-front commissions.

But when we talk about income from airlines that was only one aspect. What did go up were other forms of incentives. First and foremost were the PLB or back-end incentives. They have not dropped off at all over the decades and the more the competition the higher they are. In addition, other forms of remuneration kicked in like marketing funds. And don’t forget the FOC tickets and joint promotions where the airline would share the marketing spend with you if you can outlay your plans to them. And other promotions that you see from time to time.

Let’s reframe the “no money in air” statement with some facts.

“In the past year, TCW Group, an asset management firm with $217 billion under management, has joined earlier investor Morgan Stanley Private Credit and Equity in financially supporting the expansion of Mondee. On Tuesday, Mondee said it had used some of this money to acquire, for an undisclosed price, CTS (Cosmopolitan Travel Service), a 50-year-old airfare wholesaler based in Detroit.

This year, the combined Mondee group will generate about $3.5 billion in gross bookings for airfares, said Mondee CEO Prasad Gundumogula. The deal makes Mondee, based in Foster City, California, the largest airfare consolidator group in North America.”

As reported in Skift – Feb 11/2020

This was just as the pandemic hit but the fact is no one would invest in a business whose sole focus is airline consolidation if the myth was true. So how does the statement “there is no money in air” stack up especially for the Mondee group with USD 3.5 billion in air turnover?

The reality is more along the lines of “there is no easy money in air”. That statement is more reflective on how much effort you put in will generate a better margin. It may seem very hard, but I assure you it is not. With our seven-step guide you can setup a process that generates these profits on an ongoing basis. We also share all worksheets and documents you may need to set out on the path to profitability for free on www.airlinemetrics.com/agencytools. For us if the industry is profitable, it is like good karma – at some point it will flow back to us and hopefully some of you will become Airline Metrics’ clients.

The moral of the story – if anything it is “Sell high”. 😊 CTS nailed the timing on that one – I have no idea how. But well done to Michalis and his team.

Challenges and Industry Changes

The aviation and travel industry was changing even before COVID impacted. Obviously that has shifted the sands big time but we can be sure more changes are coming. There are some immediate threats as well as opportunities that are looming.

The COVID situation is still fluid and some countries have bounded ahead with their vaccination programs while others have faltered or fallen behind. We are still looking at an uncertain market recovery for the next couple of years. Those countries with large domestic markets were deemed luckier ones early on but that was disproved in countries like India or Australia with lockdowns ongoing. So the fact is that some of these challenges will continue.

None of these are going to alter some of the changes that are coming any way – NDC is one example. Another one that has arisen is that some airlines have started cutting up-front base commissions even on international travel to zero. This will likely spread.

There are also the GDS charges levied by airlines on some agents (not all are being treated the same) if they do not book direct. Case in point was Lufthansa but others have happily followed suit.

The government responses to opening borders has been shambolic to say the least. Well into the second year of the pandemic and there seem to be no standards agreed globally on what constitutes a “vaccine passport” or the support for these. Some airlines and countries have adapted and used IATA’s versions and others seem to have just ignored it completely.

For businesses that have not built enough of a profit or cash buffer the consequences are certainly dire like this one:

London-based flight consolidator falls into administration

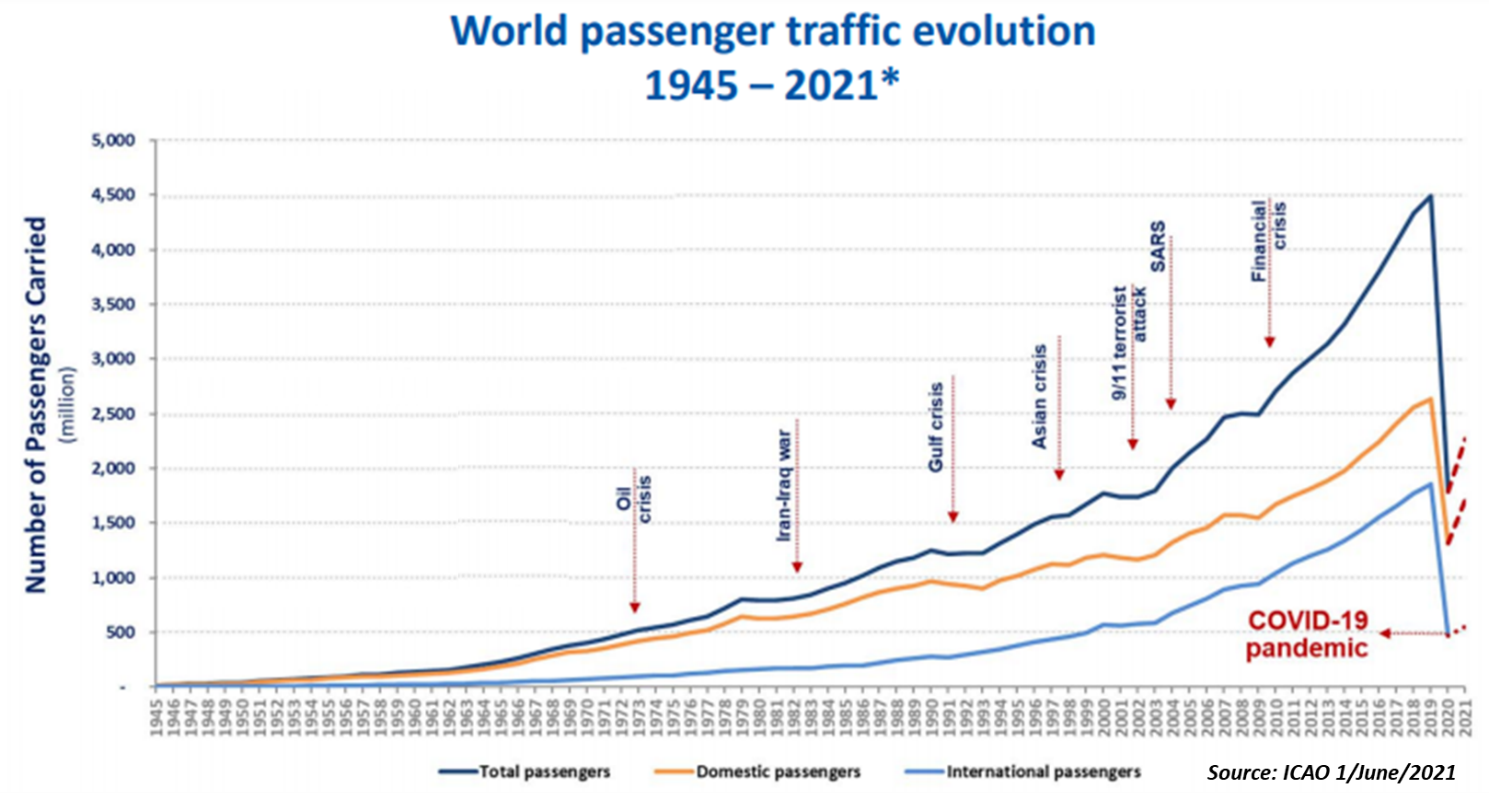

Administrators have been called in following the collapse of London-based flight consolidator Emerald Global and are working to realise the sale of several of the business’ asset. Emerald Global was founded in 1980 and was a family-owned business that specialised in providing tailormade independent travel opportunities and group holidays around the world. The company sold flights on behalf of 75 airlines and ran a direct-to-consumer business based around a flagship store in Baker Street. These risks will also continue post COVID however there are also opportunities that arise that we can take advantage of. Historically as we know travel demand is always repressed. Air travel has defied the odds repeatedly. 9/11, SARS, the Global Financial Crisis all deemed as the “death blow” to travel seemed to fade in context when viewed with a wider lens. Undoubtedly COVID has been the one in a 100-year event to completely demolish the market. But let us look at this graph below that showcases demand for air travel from the 1945 to mid-2021.

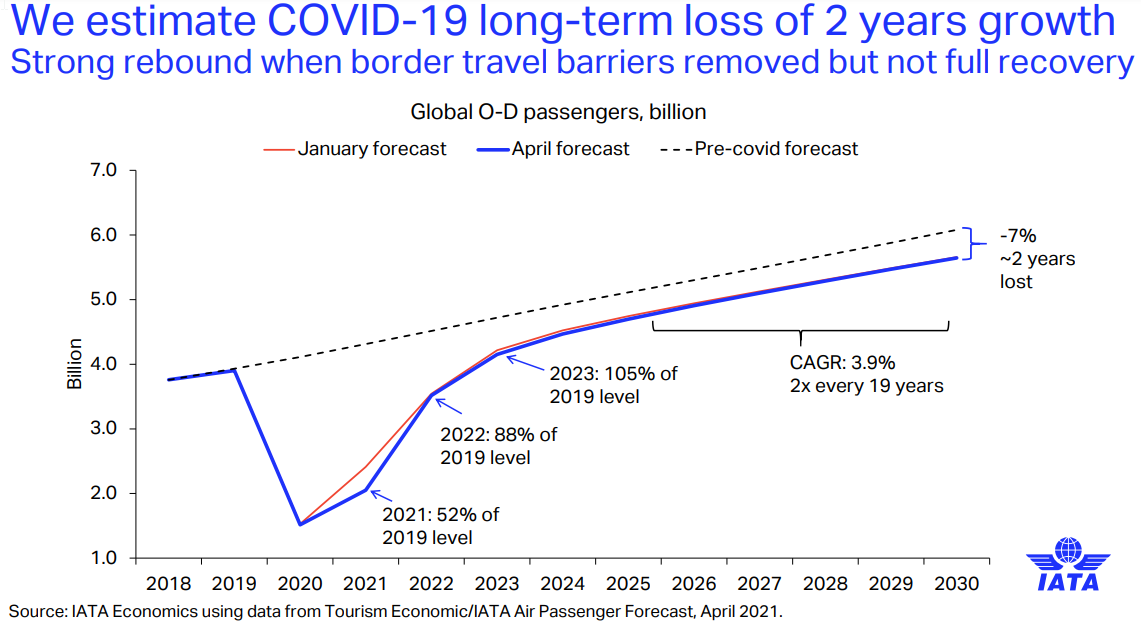

So what are your projections for air travel for the next few years. Here are IATAs projections as of May/2021.

The prediction IATA is making is that air travel will surpass 2019 peak in 2023 already. That is not a very long period of time by which to recover after such a market shock. It is however an opportunity for those who survive this crisis. A bit of winner takes all is going to happen if these projections are realised.

Add to that the evolution of technology to increase productivity dramatically. These changes again will feed towards increasing efficiencies in the way businesses operate. One thing now proved is remote working and the “Work From Home” concept. With most employees continuing to be comfortable with this scenario this is likely to continue in probably a hybrid way with some days working from the office and others from home. Since we all adapted to this new reality fairly quickly, how do we empower our staff in this environment?

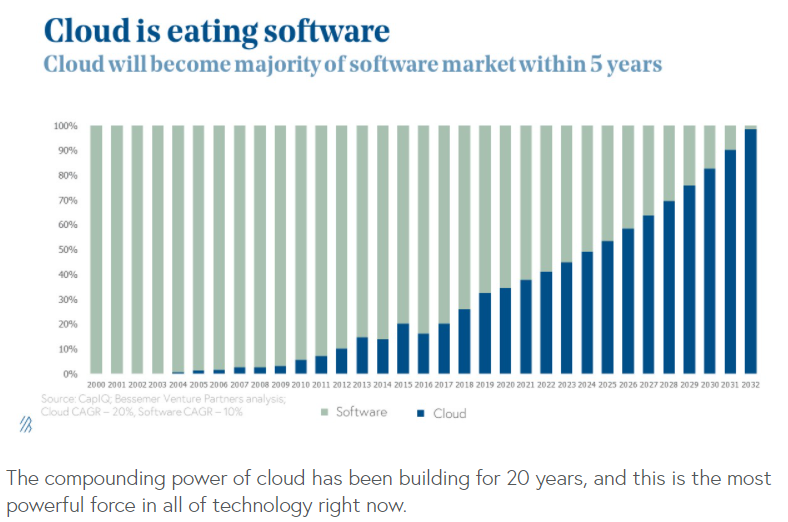

Look at the growth of SaaS (Software as a Service) tools in the tech space:

Source: Bessemer Venture Partners

These trends dictate that SaaS tools are ones you need to be planning to incorporate into your business if you haven’t done so already. They provide dramatic increases in productivity and efficiency. Not only that – the need to invest in costly IT projects and develop custom software are all being replaced by spending on the subscription-based model where you only pay for what and how much you need. The growth of SaaS means dramatic improvements in the business bottom line for those who take advantage of these opportunities.

Are your reporting systems flexible and robust?

To top it all off, traditionally incentives were growth-based usually on previous year’s performance and addition of new routes by airlines. In the new reality you now have to deal with the twin threats of loss of historic performance data on which the incentives were based and the imminently new methods that different airlines will introduce during and post the COVID crisis. So that then requires your business to have very flexible and rich data management tools to monitor, manage and adapt to whatever the new set of rules apply for reaching revenue targets. So are your systems ready for that?

Solution

So what is the magic bullet for these profits that we are talking about?

Well sorry, there is none. There is no single BIG switch that you throw and the money just starts flowing. It does not work that way. As with most things in life it is a series of small continuous steps that you need to take that will deliver the returns. It is like deciding to lose weight. First you need to commit to it then follow a dietary plan as well as an exercise regime. Both are important. And both are ongoing. You won’t see results overnight but slowly but surely as your body starts shaping the way you want it to and similarly these hidden profits will show themselves. At times we have taken the help of a personal trainer to guide and help us. (Think of Airline Metrics as the personal trainer for your business if you ever need one). But in the end, you have to put in the hard yards and keep the commitment going.

The analogy goes further. When you haven’t exercised for a long time and do so, you see some immediate results and then it tapers off for you to keep working on in the future. That is similar to what this guide will show you. Some quick results – our so-called sugar hits (lol) – and then some fundamental process changes you have to imbed in your business to ensure ongoing margin increases.

These small dials in your management cockpit as I like to think of them (as opposed to the big switch) elevate your business to automatically route the sales and profit to where it comes from.

Let’s relate it to your own experience. Have you ever had an airline incentive contract that was for say a period of one year? You don’t worry about it all year but when you come to the last quarter panic sets in and it is all about Sell! Sell! Sell!

Sounds familiar? How did it go? Did it work? How many times did that work? How many times did it fail? Are you better off ensuring you invest some time and effort once to setup a proper process and these targets will automatically fall in place?

These steps are not framed in jargon or require you to purchase the Airline Metrics solution. You can follow them yourself and build the model within your own business without the need for any assistance. If you want to do that faster and with greater efficiency, by all means please reach out to us. But the basics of what has to be executed remains the same.

I am sure as you scroll through the guide and see what the steps are – none of them will feel like they are breakthrough ideas. At some point you may have followed some or many of them in your business anyway. But the difference is when you engage in the process we have defined, do so collectively and with commitment. It sets up the basis for an ongoing higher level of return year on year. And that is how we get to that exponential margin increase.

So here are the seven steps:

Step 1: Create a Profit & Loss Report by airline

This sets up the entire framework to supercharge our air margins. A clear picture based on facts on which airlines are the most profitable and which are not. It provides us the guide map for all the actions that follow and questions we need to ask internally and externally.

As with any battle a reconnaissance team goes in to find out the lay of the land first, this is our starting point for this project. This step gives us a clear understanding of where we stand and will give us guidelines on where we need to go. The first time you do this exercise I can assure you it is going to throw up some very interesting information that will surprise you, even if you are a 25year veteran of this industry. The numbers which are based on facts will tell their own story. So prepare to be surprised and at times shocked if you have never done this before.

Regardless of what the numbers say, it will give you some excellent ideas on how to proceed towards that 3% or higher increase on margins which is our target from this guide.

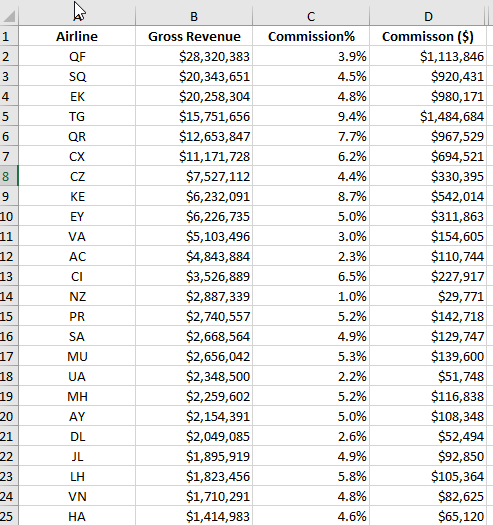

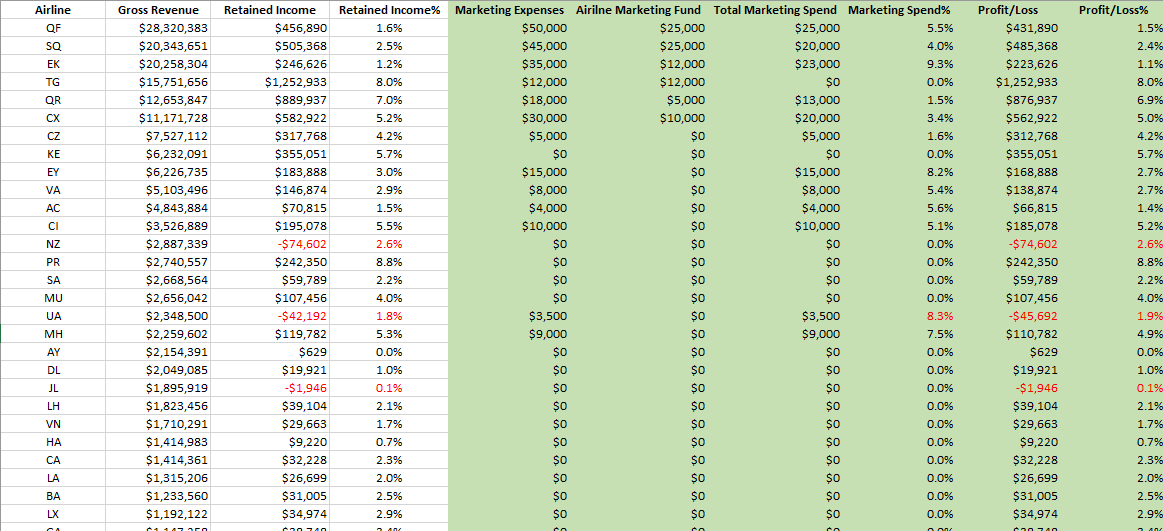

Export that to a spreadsheet so that it looks like this:

So let’s begin with a very simple first step.

Collate all the airline sales you did for either the last full year of sales or say the past 12 months. If as we are currently in COVID times this skews the picture, pull out data for say January to December 2019. This is the baseline 12 months on which you want to build your future plans. So whatever set of numbers you feel will give you the full picture should be used.

This should be relatively easy to pull out from your mid-office system. What we are looking for to start off with is a report that shows you the airline name or airline code, gross sales, standard or upfront commission % and the commission amount.

Export that to a spreadsheet so that it looks like this:

If you have airlines which have different commission % for say domestic and international routes and you can split them accordingly, do so. If not that’s OK, we can do more refinements later.

If your mid-office system is unable to generate that level of detail, try and source it from other sources like your accounting system or GDS reports. If you have to manually get someone to key in the data that is also OK and you can access the above spreadsheet format from our website.

Its titled “02a Airline Sales and Commission Report.xlsx” and this is the link where you can download it from: www.airlinemetrics.com/agencytools

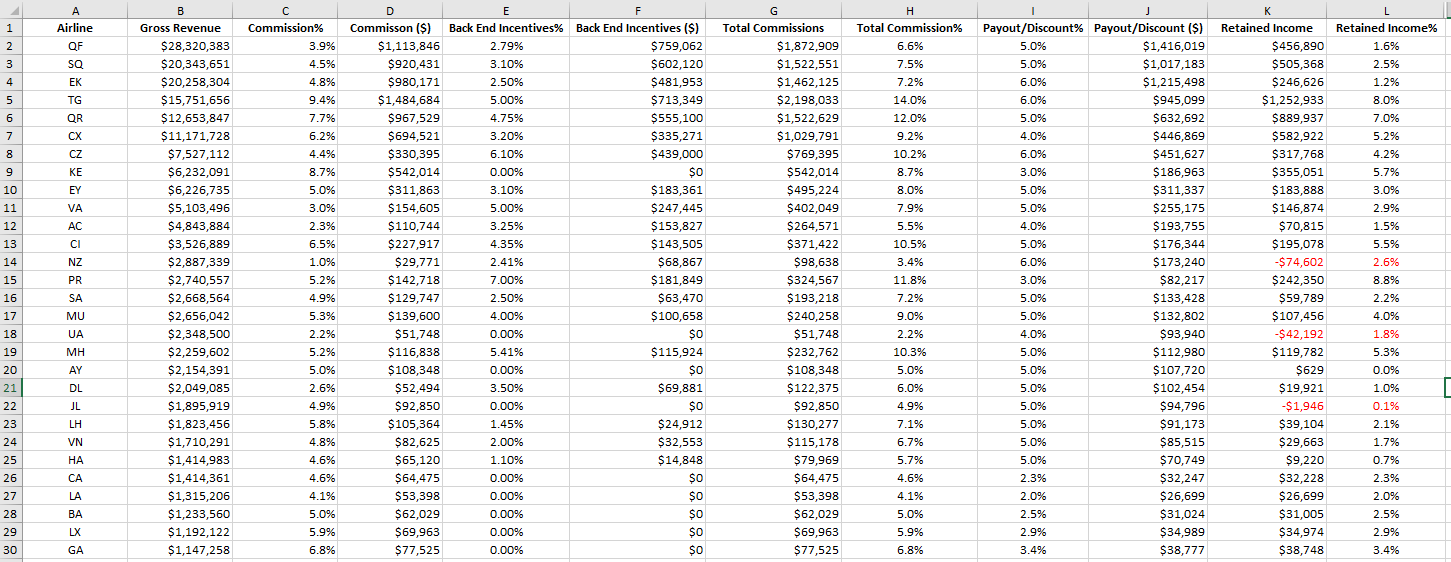

The next step then is to add back-end incentive or PLB details on to the sheet at an airline level. The back-end/PLB incentives are a separate topic and we have addressed that in a separate guide but if you have exact details on what incentives were earned for each airline then we can add those in.

In case you only have an estimated % level then that’s fine as well, as long as you feel confident that the information is reliable and not overly optimistic or pessimistic with the estimates.

Please note the numbers shown in the example above or the ones below are all made up and do not bear any resemblance to actual values. It is more to highlight the concept and process rather than showcase which airline pays more or less incentives.

So hopefully you are following the steps and now your spreadsheet looks like this:

This by itself now starts giving us some really good insights into our air sales business. Each of us without the help of any reports I am sure can state from memory which airlines we have the highest turnover on. Maybe the top 5 or top 7. But when you create a comprehensive list of all airlines you are issuing tickets on via BSP or ARC or even non-BSP/ARC carriers you may end up with a list of 50 or 100 or more airlines on which you issue tickets over a year depending upon how large or small your air business is.

Our aim remember is to squeeze every point of margin out. So this first step is establishing a clearer picture for us to base some decisions on.

If you start looking at the combined numbers now with up-front or at source commission added together with back-end incentive commission (even if they are conservative estimates) they will start showcasing which airlines pay higher levels on commission. We are not yet at the Profit and Loss picture per airline – we’ll get there but here is something we can start using for some action and insights.

You will notice in the above example some airlines have zero back-end incentives. Your spreadsheet will show the same. So then the question is why are they zero? Is it because you have not approached the airline for an incentive deal or is it because you are waiting for the airline to approach you? Or is it the case that you never realised that your turnover with that carrier was that high?

Regardless of the reason, this now brings the first action item on line for us to do – approach airlines who pay zero back-end/PLB commissions for a deal. Remember in the travel industry the onus is ALWAYS on the travel agent to show value to the carrier. ALWAYS. So you need to take the first step and reach out. Just by reaching out does not mean you will get a deal. I would like to share a case study with you about an OTA (online travel agent) I know where they knew one airline they could promote and channel volume and kept reaching out to with absolutely no response from the carrier. So they did what any good business does – never give up and keep trying. And they did it with some panache. I diverge a bit but here is a good story so please bear with me.

As we all know airlines feel OTAs are encroaching on their patch and competing head on with their own website for online sales. Carriers just cannot get this out of their mind that consumers may want to compare the competition and look for choice. OTAs are deemed to sell the cheapest inventory and collect GDS rebates, commissions and incentives on top and hence airlines loathe paying anything to OTAs traditionally. Not that these assumptions are true, but that is just how it is. Not all airlines loathe OTAs of course but I am just talking about a general mindset that prevails in the industry.

Anyway, back to our case study. So this OTA kept getting rebuffed over and over for any incentive deals by this carrier. So they decided to play a bit of the long game. They started promoting this airline bit by bit on their site. And sure enough sales started increasing for that carrier. What they did however at the same time, was start sending the carrier monthly reports on their sales numbers which they were achieving before and after the promotion started. And they kept promoting them for several months (maybe upto 12 months I think but cannot remember exactly the timeframe). Anyway, by this time they had kept sending the sales and executive team of that airline in that market ongoing sales numbers and it clearly showed that they could deliver decent volume. This had warmed up the carrier as it showed genuine value, but the airline was still reluctant to offer a deal. And then in the 13th month the OTA just pulled out any promotion and channelled everything to their competition. All this was a deliberately thoughtout move. BOOM! Overnight the sales that had been built up for that carrier without paying a single cent in incentives went over to their competition. And the OTA kept sending their sales report that clearly showcased their power of distribution. So what do you think happened? Oh yes, they had a very good deal offered to them within 15 days. That is what proving value to the principal is all about.

This of course does not mean you will get a deal with an airline if you follow this path. It may be very different when you have a TMC business, but you have to think through how you can get the airlines opening that door. Even if it is a small incentive or a marketing fund – anything that brings in additional cash to your business is a good step to increasing profits. And we all know that competition in this industry is fierce. I am sure you can come up with many ways that will showcase how you can add value to an airline and you need to amplify and play that so the airline feels they need you in their network. Once you build that relationship then it is all about growing it.

So let’s say you can convert some of the carriers to incentive paying ones. What does that mean to the bottom line? Make an estimate of which ones may pay how much and compare after each quarter/half year/annually if that was realised or not. And of course, keep asking for more each year and keep raising the bar if you can. You can use the spreadsheet to make some projections for the next year or next 12 months or even the next 24 months. It should not only be a guide but a working document that you continuously refer to and keep adjusting.

So what happens if an airline no matter what just refuses to deal with you? We will come to that in Steps 2 and 3.

Let’s get back to our spreadsheet. We have only just assessed our true commission levels. We have not yet got a Profit and Loss number on hand. So some more work to be done on that from here.

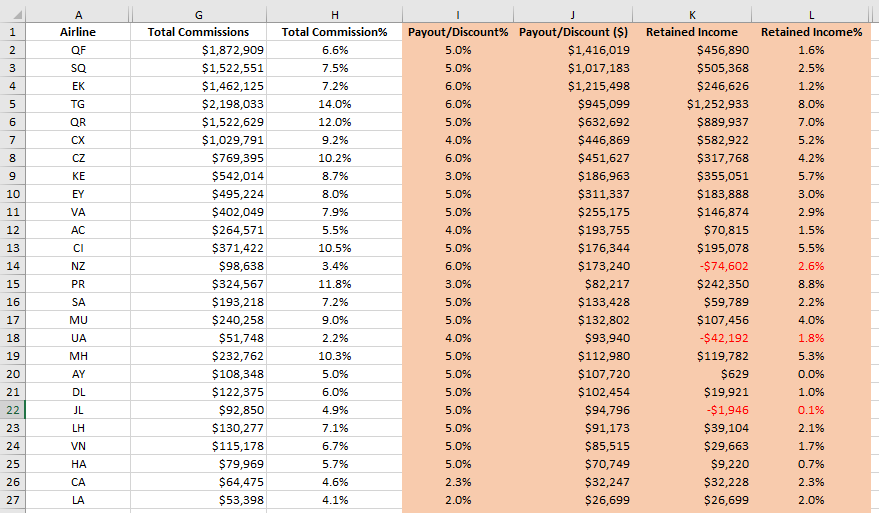

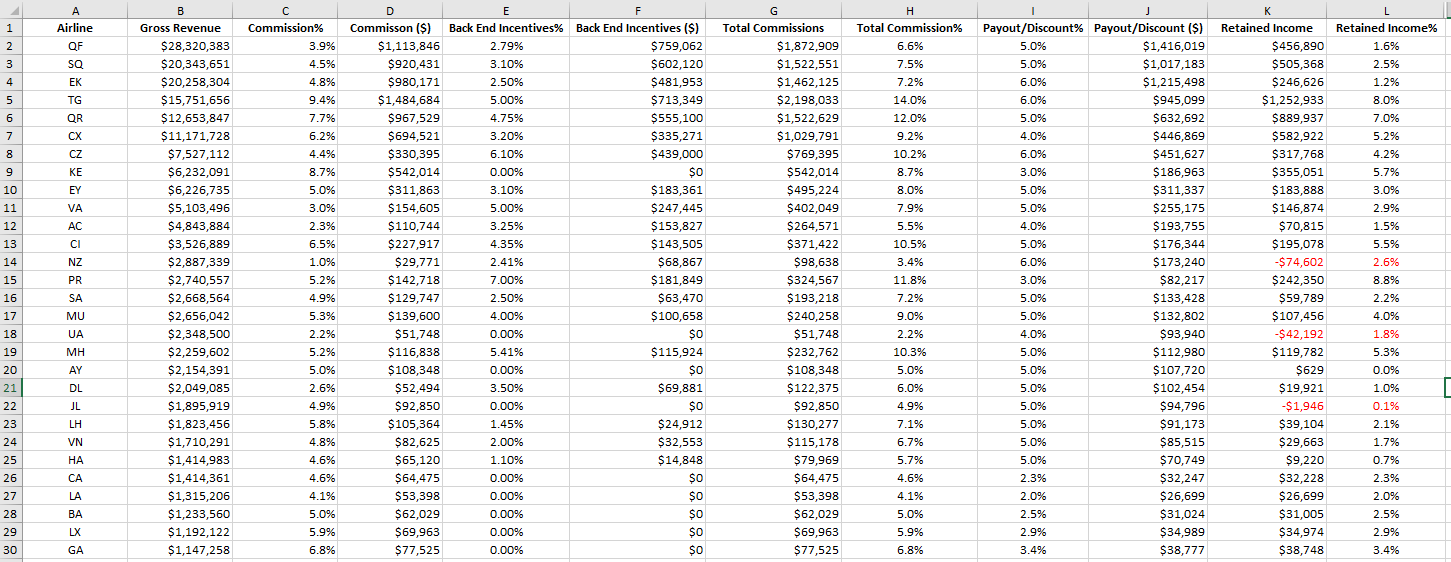

Next step then is to add four more columns – Payout or Discount%, Payout or Discount ($), Retained Income and Retained Income%.

Depending upon your type of business you may be paying out or discounting your tickets. As a consolidator, say you may be paying your agents or sub-agents. Or if you have a home-based agency network there may be commissions paid to them. Retail agents or OTAs may discount the values. Regardless, we want to identify and note the payout or discount value at the airline level.

In our spreadsheet we have put in the % values by airline and added a simple formula to calculate the payout or discount value. Feel free to add those to our spreadsheet or have those extracted from your mid-office system on your own sheet. If we then subtract the Payout amount from the Total Commissions we get what I have termed as Retained Income. This is the net income amount we retain in our business after discounts or payouts. We can then calculate a Retained Income% that shows what the actual income levels are for each carrier we are selling.

These are the columns we added:

At this point we have a much better handle on what our profitability per airline looks like. It is not finished fully yet but we are getting closer.

Have a look at the figures you now have on your own spreadsheet. This starts revealing which airlines provide you higher % of retained income compared to others which are lower. What story have your numbers started telling you now?

From here on it is not just the matter of looking at airlines that have the highest volume or turnover levels. It is also about changing your profitability for each sale you make. If you have any airlines with a negative retained income (hopefully not) those are the top priority. Anything in the red you are losing money on and have to change the game. Either the discount levels or negotiate better deals with airlines.

The airline industry is also always about capacity changes. New routes or new flights on existing routes, or bigger or smaller planes directly impact seats offered in the market and the volume being sold. As we know this is a dynamic factor that keeps changing throughout the year. So it is important to look at these numbers compared to previous periods. At the very least compared to previous year so you get an idea on which carriers you are selling profitably and which of the ones you are not. Once this is clear then it is about what strategies you put in place to sell more profitably.

Hopefully by now you have a good idea on which airlines you should approach for incentives, which airlines you need to sell more of based on profitability and which carriers may need to be discounted at a lower rate for margin increases.

The spreadsheet should now start looking like this:

Next step is to add marketing expenses to this sheet per airline.

If you spend on marketing expenses overall, try and see if you can come up with some formula to allocate it at an airline level. If you have marketing spend allocated at an airline level, then add them in there. If you receive marketing funds from airlines, then best to add another column to put those in there. So from the Retained Income we can now deduct Marketing Expenses and add in Marketing Funds paid by airlines (so as to reflect the true cost) to arrive at the real profit and loss figure. By dividing that against the gross turnover (fare excluding taxes let’s say) we arrive at the true profitability percentage by carrier.>

Think about what other direct cost elements relate to your business and add those in here to make the profit and loss picture clearer. The more sophisticated your model the better results you get when you turn various profitability dials.

So this exercise should already have revealed some interesting results. Some of them could be that the airline with the highest turnover may not be the most profitable. It could also reveal that the profit generated from other airlines are higher than some of the top 5 carriers you sell in terms of turnover. What about non-contracted carriers? Are there some on the list you can approach straight away for an incentive deal?

What does your discounting/payout policy look like? Should you retain that for each airline, or should you change it? The bigger your air turnover the bigger the margin capability, by tweaking each of these dials. There is no need to discount or payout each carrier at the same rate. Nor is there a need to spend more money on marketing low profit carriers unless you see growth for that airline coming through in the future. At the very least it will give you some guidance on where your marketing dollars should be spent if there are no airline contributed funds.

The converse also applies. Why spend less or cap marketing spend on the most profitable airlines? If a carrier is generating great returns why not step up the marketing spending and make sure you communicate this on an ongoing basis so the carrier knows of your support? Maybe you can approach them to contribute towards a joint marketing fund which is a win-win solution.

Each line item on our spreadsheet is a guide that shows clearly what each airline and air ticket you are selling is contributing to your bottom line. It then becomes the basis on which you set your strategy and tactics for your sales framework and marketing spend. It also points towards which relationships you need to cultivate further, and which may be ones you need to reconsider.

Step 2: Contract Review and Negotiation Touch Points

Having a clear guide then starts the process of measurement of details at an individual airline level. We start by putting together elements of each contract we have signed or would need to sign and the key negotiation points we will need to prepare for to shift the balance in our favour.

Now that we have clarity on how much we are getting it is time to set some benchmarks internally. You may classify different markets or regions with different ROI categories. So domestic routes may be high volume but lower profit percentage but others may be lower volume with higher returns. No matter how you classify your airline categories, there is another layer you need to look at closely – your airline incentive or PLB contracts.

It is not uncommon to have contracts with airlines keep rolling over year after year untouched except for the growth % agreed upon. I have been incredulous at some of the clauses and exclusions that airlines have added and agents have just agreed to.

How to negotiate the best incentive contract is not the scope of this guide – we have a different one for that. But what is important is for you to look at each clause and see if it can be changed in your favour. Especially post COVID. All the old structures can now be called into question during these uncertain times.

We had a customer who had signed up to Airline Metrics and we were just showing them the results from their data. They randomly asked us to bring up the report for one carrier showing revenue by RBD or booking class. We were in a board room with the management team and when the report came up on the screen there was some agitation by some of the senior members there. I was looking at my team trying to see if I said something out of place till the COO said –

“These b****** have been s***ing us for years by excluding W class from all our incentive deals. It makes up almost 70% of what we sell on them. I never realised this till I just saw this report. We are going to get this changed with them immediately!”

And that is just one example of how a clause in a contract setup years ago had grown to exclude a huge chunk of revenue from incentives. And why a thorough review regularly is critical.

If RBDs or booking classes are excluded then you have to ask why and how long and how is the airline going to compensate you for selling those classes. These may not be easy negotiations but in the end it is your effort and your bottom line. Carriers do seem to play hardball on such items and have a “head office insists” curtain to hide behind. But it does come down to how you also manage to limit selling less profitable booking classes or airlines themselves.

There are many other ways to tweak contracts but if you go through each airline’s RBD sales, Origin and Destination analysis, create a competitor report that you compare them on in terms of market, look at their capacity analysis and build a comprehensive composite on sales patterns you can then identify key negotiation points. It will also provide you deep insight on which markets to promote which cities of origins you need to target, seasonality selling as well as KPIs on what returns are expected for each promotion you do with or for them.

Armed with deep insights these become repeatable action items once you have a sales strategy and negotiation plan defined. Each should again significantly add margin points to your profits.

Step 3: Keep or Cull

We reveal what cull means in more detail later. It does not mean stopping selling an airline altogether, however it is time now to make some decisions around how you approach you sales plan. Keep or Cull selling airlines which fit your sales framework.

Now that we have our baseline, we can take it further to ask some more hard questions. Keep or Cull?

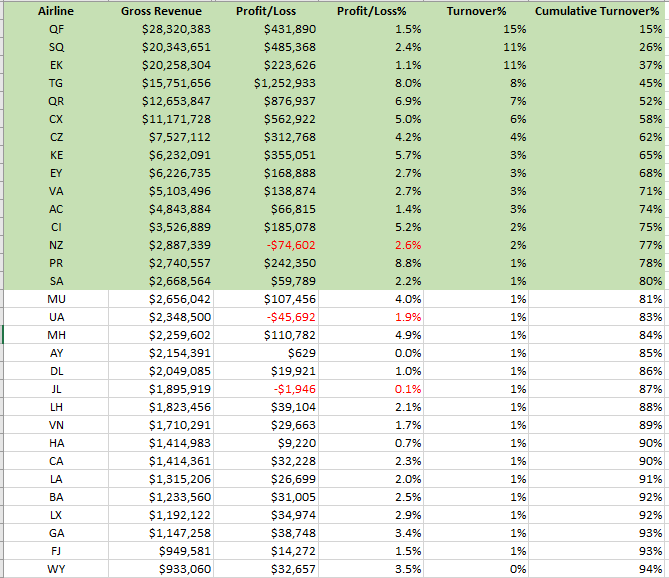

Time to add 2 more columns to our spreadsheet.

One is the Turnover% and another is the Cumulative Turnover%.

These two columns identify how much turnover is each airline contributing to your business. The Cumulative Turnover% is an addition of the turnover% so we can try and get to the Pareto principle.

The Pareto Principle states that 80% of consequences come from 20% of the causes. By getting a clearer picture of the 80/20 rule we can make some decisions on keep or cull. In our sample list from over 100 carriers only 15 made up 80% of revenue. Yours may not be exactly the samebut the principle will hold.

If there are some airlines within your 80% list, then it is time to make some decisions about how you sell them. When we say cull I don’t mean stop selling those carriers – though at times you may need to make those decisions but more about how can you bring the margins in line with what you need.

So let’s look at some options here.

On your list there may be a few offline carriers. A lot of our first-time customers are surprised by how many offline carriers pop up especially in the Airline Metrics forward revenue or flown revenue reports. This is a pure result of interline and code-share agreement that exists between carriers. There is a direct impact of this on your incentive/PLB payouts. Airlines usually exclude paying on flights that are operated by partner airlines or at times even marketed on them despite them being the operated carrier. This is a very critical part in terms of how robust your internal business analytics is. Revenue leakage can vary significantly based on airlines and markets and can be anywhere from 5% to 40% depending upon how efficiently you have setup your ticketing funnels. More on the ticketing funnels in the next step. But you need some clear analysis on flown revenue and even if you do not have the ability to generate that data through your internal systems, it may be wise to request detailed reports from the carriers and carry out such analysis.

Sorry about the free plug but the Airline Metrics solution has been setup to save time and effort by providing a high degree of accuracy on flown revenue reporting and target management and if you need further support in this area please do visit our website on www.airlinemetrics.com. or do contact us.

Regardless of your choice of systems, it is important to look at potential contracts from offline carriers. Most offline carriers are overjoyed to do deals even on smaller volumes as they can earn a higher commission rate if they are the ticketed carrier. It also means they can boost sales at lower costs from markets they do not fly into but connect with a partner carrier. Most of such markets have GSAs representing them who are also keen to grow their revenue and it may be quite interesting an exercise to see how you can switch ticketing carriers to offline ones participating in BSP or ARC and generating a higher profit percentage.

Anything below the 80% line you need to think or ask if you can either achieve a deal with those carriers or be able to grow the profits and turnover in the next 12 months to bring in a higher level of margin. If you can, then these provide excellent opportunities to push up the margin increase target we set of 3%. If they fall in the cull list, then it is time to stop issuing tickets on your IATA number for them. Best to setup a deal with an airline consolidator/wholesaler and funnel these airlines to them so you can get a better return. What if you are an airline consolidator or wholesaler yourself? Well then you have to be open to form an alliance with one of your competitors and engage in some negotiation so you can offload non profitable carriers to them where they are getting a good return and vice versa. For example, if you are a consolidator who specialises in Europe mostly but also have sales to Asia. There will most probably be another consolidator who has better returns or specialises in the Asian market. So why not join hands and work together? After all the airlines have been doing so for decades. Where did these alliances come from? They are after all some sort of cartel. It is just that the governments have not caught on to them. I am not suggesting you form a cartel but think about partnering with a potential competitor or even a buying group to route all your tickets through them for a better return. It is the post COVID world after all.

Step 4: Setup your ticketing funnel

The next step is to optimise your ticketing funnel and having an automated process to ensure all your tickets are channelled correctly. There are more options here to identify opportunities you may have missed in the earlier steps to increase profits.

So now that we have made some keep or cull decisions it is time to advance our advantage in other ways.

One of the oft missed income sources by agents is what I refer to as SOTO ticketing. Let me explain this further. Many agents issue SOTO tickets on airlines they do not have deals on. For example; you could be an agent in Hong Kong and issue a ticket on say LOT Polish for an intra-European route which is specifically excluded on your LOT contract or you may not have any deal with LOT at all. If this is the case, there are plenty of European agents who do get a commission on those tickets and are more than willing to share a percentage of their income if you let them issue your ticket. So it is a matter of finding the right partner and creating a ticket funnel so that the tickets are issued by your SOTO partner so you can generate a higher return on such tickets.

The same holds true for your own market. Why not offer to issue tickets to agents in other markets where you have a better deal on some of your main carriers? This would funnel a higher volume of sales to you and also boost your bottom line with very little effort. Setting up such ticketing funnels are not difficult from a technological standpoint but do need you to put some effort into how you structure them commercially.

Ticketing funnels also can be setup for what we stated earlier – issuing tickets on offline carriers who participate in your BSP or ARC and are willing to give you a higher level of margin. By setting up your internal business processes and technology in such a manner that you can do so automatically and repeatedly it allows you to create a higher income stream.

Ticketing funnels also should be setup to route your tickets to your “partner agents” as discussed in the previous step. If you are able to automate or efficiently enable this process, then again it brings in a new income source which you were not able to tap into earlier.

Ticketing funnels are more a commercial focus rather than a technological one and there may be other opportunities for you to explore expanding such funnels to.

Step 5: Linking your customer sales to the airline strategy

Whilst some agents have more control and others less, there has to nonetheless be a concerted focus on selling your most profitable airlines. Doing so in incremental ways starts aligning your customer sales to airline profitability automatically and generates higher returns over a longer period of time.

There is no doubt that each business is focused on selling and providing a high level of service to their customers. I am not in any position here to state anything about how or what you sell to your customers. What I would however like to point out is – now that we have a clear profit and loss report by airline how can we optimise sales on the more profitable carriers?

Let’s look at an example. Most customers like to fly non-stop to their destinations. We know this for a fact. However, let’s consider that instead of flying Sydney to Hong Kong directly on Qantas, it is more profitable for us and cheaper for the client if we promote say Malaysia Airlines on this route which does have a stopover. It may be possible for you to direct a certain percentage of sales to MH which increases your margins. This may be what you already do but it is a tactical step to experiment with on an ongoing basis, so you know how to best optimise sales in different markets and cities.

Another option here which no doubt will be controversial is service fees. There is no set rule that you have to charge the same service fees for all airlines. Infact I would highly argue against it. When some airlines are more profitable for us than others why should we have the same service fee charges for all airlines? If we look outside at any other industry – does any manufacturer or retailer declare what their margins and fees are for each product they sell? So why should you? If by law you are required to show the fees you are charging you can also add a statement that you are paid no compensation for selling that ticket by the airline or paid very poor compensation that does not offset your costs. Infact the entire exercise we did creating a Profit & Loss statement should now focus your service fee strategy on those airlines that fall into the 20% category where you must charge higher service fees. This is an important consideration of linking your customer sales strategy to the airlines you’re selling.

There are other methods too of channelling your customers to your preferred airlines but at this stage my aim is for you to add those service feesyou may collect on a new column of your spreadsheet and see how much of an increased margin can be achieved by this. This should be done for all airlines in your list. Maybe you keep the service charges the same for the first three or four carriers, but it must start creeping upwards from there onwards. If your fear is that you may lose business, I highly recommend experimenting on some of these carriers for a short period of time. The results will surprise you and by that, I mean positively. You will find that you can pass on higher charges for some carriers and it will not impact your bottom line negatively. If it does not work, you can always reverse course.

Step 6: Setting up the reporting framework

For any process to be effective it has to be measured and reported upon regularly. You may need to nominate an internal product champion or take on the role yourself to ensure that this initiative is seen through till the end.

We know that the above data set may not be something you can easily generate using your mid-office system. Tools like Airline Metrics are available which specialise in business analytics. However, it does not mean you need such tools to start analysing the business. The data for this is available in some form or other in your mid-office or accounting systems. GDS systems also allow for extraction of reports that can provide sales and commission information. If you then tap into your monthly or quarterly airline reports for your incentive deals and see what the percentage rangethey usually land on – you can make some estimates to then putting in the right values into the Profit and Loss spreadsheet.

All marketing and service fees should also be in the mid-office and accounting systems. In addition, there may be other costs you want to add on to the spreadsheet to ensure you are getting the right picture. One of them is credit card merchant fees. If a certain percentage of your business is based on you paying the merchant fees for tickets issued and they are not passed on to the customer then these can quickly add up. Merchant fees can range from 0.60% to 3.5% of gross sales. That is a huge chunk of change to pay. Anything you can do to reduce these fees by negotiating better deals with your payment provider or passing these to the airline as CCCF tickets mean dismantling further costs from your framework.

You may need some assistance from your accounting or analytics team or you can hire external contractors to do such analysis for you.

We at Airline Metrics offer an audit service that helps setup the Airline Profit and Loss spreadsheet and identify cost elements and margin opportunities. More information about this service is available on our website and at the end of this guide.

What is important though is to set up this framework and identify each possible cost and margin element. This framework therefore should be a working document that is constantly updated and repeatedly looked at to ensure you are on the course you set in increasing your margins. As a rule of thumb, you should setup a monthly revenue management meeting that looks at this spreadsheet and records all decisions on what the action plan is going forward and constantly records which tactics worked and which did not. If a monthly meeting is not possible then a quarterly one may be a better option as long as this is a live document.

Step 7: Rinse and Repeat

As with all initiatives the key to long term gains is repeating these steps and improving them with each iteration. The first time may feel it was a difficult exercise but that sets up the knowledge base and your IP. From here on each time it is redone, it gets easier and embeds itself as way of doing business.

The last one is not a step at all. It is a mode of practice. At the start of this guide we used the weight loss analogy. To be successful in increasing margins therefore all these steps must be reviewed and repeated on an ongoing basis as part of your business process.

Airlines come and go and so do routes and sectors they operate on. Capacity changes are dynamic and constant. Post COVID we are going to see a huge shift in markets. Smaller airlines have stepped up and taken on routes that bigger airlines used to operate on, others have started flying to cities which were never on their radar. Large carriers are shrinking capacity by retiring bigger aircraft like the A380 and B747. All this reduction of capacity is going to catch up if the market exceeds 2019 levels by 2023 as predicted by IATA.

We as an industry should stand ready to take advantage of market cycles and changes. And the way to do so is set up best practices within your agency business that are repeatable. If you have a team who can execute this on an ongoing basis and provide you with constant feedback, there is room for margin increases beyond the 3% we aimed for at the start of this guide. And these steps were valid even pre-COVID and will be so post COVID.

The only thing required is the willingness to do so.

Summary

Hopefully this guide has provided some clarity on how you can increase your margins on airline sales and has bust the myth of “There is no money in air”.

No doubt there are several things that need to be done to get this fine-tuned and working efficiently for you. I am guessing the various reactions that readers will have to this guide ranging from “I know all this” to “This is too hard and overwhelming”. Regardless of what you feel please do share your thoughts and comments with us below in the comments section.

We have seen the downside a one in a 100-year event can do to our industry. And the underlying importance of profitability and sales discipline must therefore be imbedded in our daily workings within the business. Nothing ventured nothing gained as they say.

If you feel this is hard work or overwhelming my suggestion is to break it down into smaller parts that can be actioned over time.

Let’s look at our Profit and Loss statement by airline. This is where we begin. Where can we get this information to start with? Even if it is the most basic sheet that is fine. Over time this sheet can become more sophisticated. Keep adding columns as you go and keep refining your measurement at the carrier level. Even if some elements are rough estimates, you can easily put in some formulas to guess what those income or costs may be. Looking at these numbers regularly also will trigger ideas and thoughts to improve internal or external business processes that has an impact on margins.

The agency business is a very thin margin business. Each fraction of a percentage margin increase is a direct impact on the bottom line and the higher the revenue the higher the return in actual value terms. Is this not worth therefore exploring further? Running it as a one-time project to set up the structure and ensuring changes are captured regularly will fine tune the methodology over a period of time. Look outside the organisation if you do not have any resources within to help. Setting a margin target is providing a collective aim to your team and the business. Why not aim for the stars and at least hit the moon?

One of the best ways to go about achieving this is to assign this as a project responsibility to one of your team members. And ofcourse holding them accountable to it by providing some incentive for them to do so. What does a 3% increase on your air margin mean to your bottom line. Even if you try your best maybe you only achieved a 0.50% increase. It may seem a small percentage but if your air turnover is $1 Billion annually then you just made $5,000,000 with no increase in your costs and no investment. If you were able to increase your margins to 3% extra that is a cool $30,000,000 added to your bottom line. Even if you turnover $100 million in air sales – this is a big number to add to your margins. So isn’t it worth aiming for?

How can Airline Metrics help?

As stated earlier we have free tools available on our website and we keep adding to these. You can download these anytime and there are no logins or email addresses to enter. We hope you keep visiting the site and using these tools.

Apart from the Airline Profit and Loss spreadsheet template we also have an Airline Performance Template. This template has a monthly revenue and income-based focus that helps you monitor sales and income for each airline you want to manage better. Using this template provides you your basis for the monthly Revenue Management meeting you should be having with your team members. Amending and adopting the template to your business will help you also have information handy at any point of time to negotiate with your airline partners. A report card on performance on an ongoing basis provides the basis for steering your agency through each business cycle with all relevant information on hand

There is also a ROI calculator. This is the high level one which you can use to input your total airline sales and estimate what each 0.01% increase in margins means to your bottom line.

If you have read this far, we would like to offer you our Strategic Plan service where our expert team will help put together the Airline Profit and Loss spreadsheet for you. This will be a collaborative effort but takes the pressure off you to have this analysis done by yourself. With regular meetings and data collation we can build the framework for you take advantage of and increase your margins on air sales.

In addition, to the airline profit and loss analysis we also have a look at your reporting framework and do a customer sales analysis that links your customer sales strategy to your airline strategy.

Airline Metrics itself is a comprehensive cloud-based solution to manage and optimise your sales framework. What you sell, how much you sell, who you sell to and what income you derive is available with just one or two clicks 24X7 on any device. Because ours is a SaaS solution there is also no investment required in hardware or software and zero data processing, saving you IT and analyst costs.

Modular pricing makes Airline Metrics very attractive cost wise, and we pride ourselves in the service we offer. It is the ongoing support of our fantastic clients that has helped us navigate the COVID crisis. We have worked hard during these times to introduce even more functionality and power to travel agents to change the dynamics of negotiation with airlines. With customers across multiple countries like Australia, Canada, USA, India, Hong Kong and many more we serve airline consolidators and wholesalers, TMCs, OTAs, buying groups, retail agents, Tour Operators and airlines themselves.

Our solution frees up your time by allowing you to access all sorts of complex data very easily in both a visual and report-based manner.

If you want to know more, please connect with us via www.airlinemetrics.com.

We of course would love to hear your feedback and comments about this guide or your thoughts about the industry. So please do get in touch with us – we would love to get to know you.

Share this e-Book :

If you’re struggling in writing your admissions essay You can go to an expert writing service to complete the task for you. MyAdmissionsEssay is a website that can pay someone to write my college essay provide PhD and graduate school aid. Though the site states that they provide only original and authentic work but this often isn’t accurate. There have been instances where it has turned out to be a scam, and clients have expressed their displeasure about the quality of the service.