Summary:

We empowered one of our corporate customers to identify and negotiate new airline contracts by providing reporting packs on air travel spend.

The Problem:

Navigating the post pandemic corporate travel landscape was a challenge for Joey who heads Travel Management for a large company based out of the US. Prior to the pandemic his company spent upwards of USD 20 million annually on flights. He had negotiated contracts with two domestic and five international carriers which ranged from discounted airfares to free lounge access as various perks for employees travelling on those carriers. Their spend slumped during the pandemic and was recovering gradually with an expected increase to “normal” levels some time during or after 2023. But all contracts had to be revisited due to the dramatic change in their spend patterns. Whist they were receiving several reports from their travel agency/Travel Management Company they were not insightful enough to provide them enough information to not only know which airlines to target for negotiations but also what information to present during such negotiations. In addition, he was desperately short staffed and did not have time to spend analysing and building reports.

The Solution:

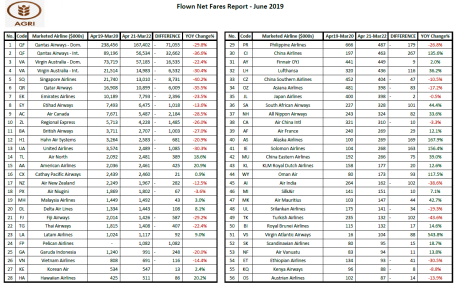

Joey subscribed to Airline Metrics’ monthly “Snapshot Analytics” reporting service which provides summarised reporting on all his air travel spend. The reports were sent to him each month and showed air fare spend by carrier including year-on-year changes that highlighted change in spend % by airline. The reporting pack also included spend by airline on “flown revenue” basis which is what airlines measure revenue on that allows like for like comparisons as opposed to “ticket value” reporting. This meant the ability for Joey to demonstrate exactly how much money was retained by each carrier excluding taxes and any revenue leakages via “code share” flights and vice versa. The information also covered top domestic and international destinations, the spend on each of those sectors as well as which airlines were getting the highest spend for those markets. All reports were presented in graphs and tables and were made available in both pdf and Excel format. This also allowed Joey to use them in his presentations to various stakeholders quickly and add further amendments and notes as needed.

The Result:

Joey was able to renegotiate not only all of his previous airline contracts but it also enabled him to identify and reach deals with other carriers who he could target using the new reporting he subscribed to. This was despite the fact that their spending was still significantly lower than the pre-pandemic days. Airlines who themselves were significantly short staffed appreciated the proactive manner in which Joey was able to provide accurate and relevant data for them to base their discussions around and were able to assess and sign off on contracts much quicker than Joey’s peers. It was a very successful outcome internally as well for Joey and his management team were very impressed by him being able to deliver better value on their air spend even though the spend had decreased since the pandemic. An excellent outcome overall.